"The process by which banks create money is so simple that the mind is repelled."

Fractional-reserve banking is based on the belief that not all bankers will ever demand their money back at the same time. By only keeping a small portion of deposits in reserves and lending out the rest, banks are able to create new money in the form of loans and profit off the interest.

This system has been criticized for contributing to inflation and economic instability, as well as benefiting the banks at the expense of the general public.

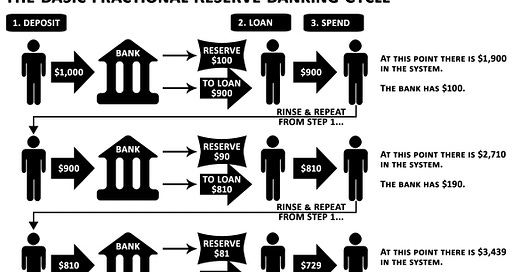

The Multiplier Effect

Let's say you deposit $100 into your savings. The bank is required by law to hold a certain percentage of that money in reserve, but it’s just barely 10% on average.

This means the bank can lend out the remaining $90 to someone else, who then deposits that $90 into their own savings.

Then the new bank lends out $81 of that $90, while only saving $9.

The cycle keeps repeating because each bank is incentivized by profit made off the interest paid back on loans.

After just three cycles of this model, the $100 bill you deposited now represents over $340 in digital USD that doesn’t really exist in cash form, meanwhile only $10 of your $100 deposit has been saved by the bank.

Bank Runs & Bailouts

Bailouts encourage banks to take greater risks, knowing that they will be bailed out if they fail. This can ultimately lead to even greater economic instability and financial crises.

The amount of money held in private bank accounts currently exceeds the amount of physical dollar bills held by the banks.

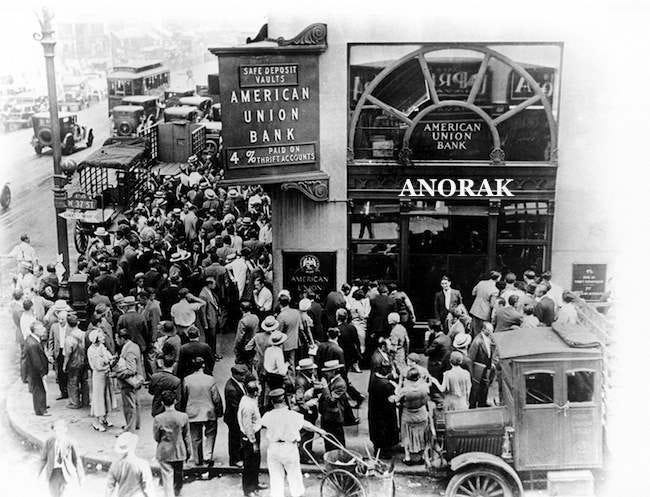

If too many people try to withdraw their money at the same time, this can lead to a situation where the banks run out of physical cash simply because they did not reserve enough of your deposits.

When the bank doesn't have enough money in reserves to cover those withdrawals, it may have to close its doors and declare bankruptcy. This is what happened during the Great Depression in the 1930s, when many banks collapsed due to a lack of reserves to cover withdrawals.

Nowadays when these institutions collapse, they often receive a bailout from the federal government, meaning that taxpayers are effectively subsidizing financial malfeasance.

During the 2008 financial crisis, several large financial institutions, including banks, investment firms, and insurance companies, were on the verge of collapse due to their irresponsible management.

In response, the U.S. government passed the Troubled Asset Relief Program (TARP) in October 2008, which authorized the U.S. Treasury Department to use up to $700 billion to purchase troubled assets from these institutions and provide them with capital injections.

The funding for TARP ultimately came from Taxpayers, as the U.S. Treasury Department sold bonds to investors and used the proceeds to finance the program.

The bailout program was controversial and faced criticism from many who argued that it rewarded irresponsible behavior by rescuing institutions who took on too much risk at Taxpayer expense.

Central Banks

Nowadays, central banks exist to help prevent bank runs and reserve failures. These banks, such as the Federal Reserve in the United States, loan money to struggling banks to help them stay afloat.

Additionally, when institutions want more money to lend, they can just ask a central bank for help.

The Federal Reserve lends money to banks, who then loans that money to customers. 90% is then lent out to somebody else after being deposited.

This has led to massive inflation and rapid devaluation of the dollar, effectively stealing wealth from the people through a hidden tax.

Central banks around the world are using the current economic crisis as an excuse to push their agenda of greater control over the financial system and move towards a cashless society.

Their policies favor big banks and the wealthy elite at the expense of the working class. Perpetuating income inequality and further devaluation of the US Dollar.

By manipulating the financial crisis they created with fractional reserve banking, they want to convince the public that drastic measures are required.

In reality, this is just another way to consolidate their control over the financial system and increase their power over the population.

Digital Currency

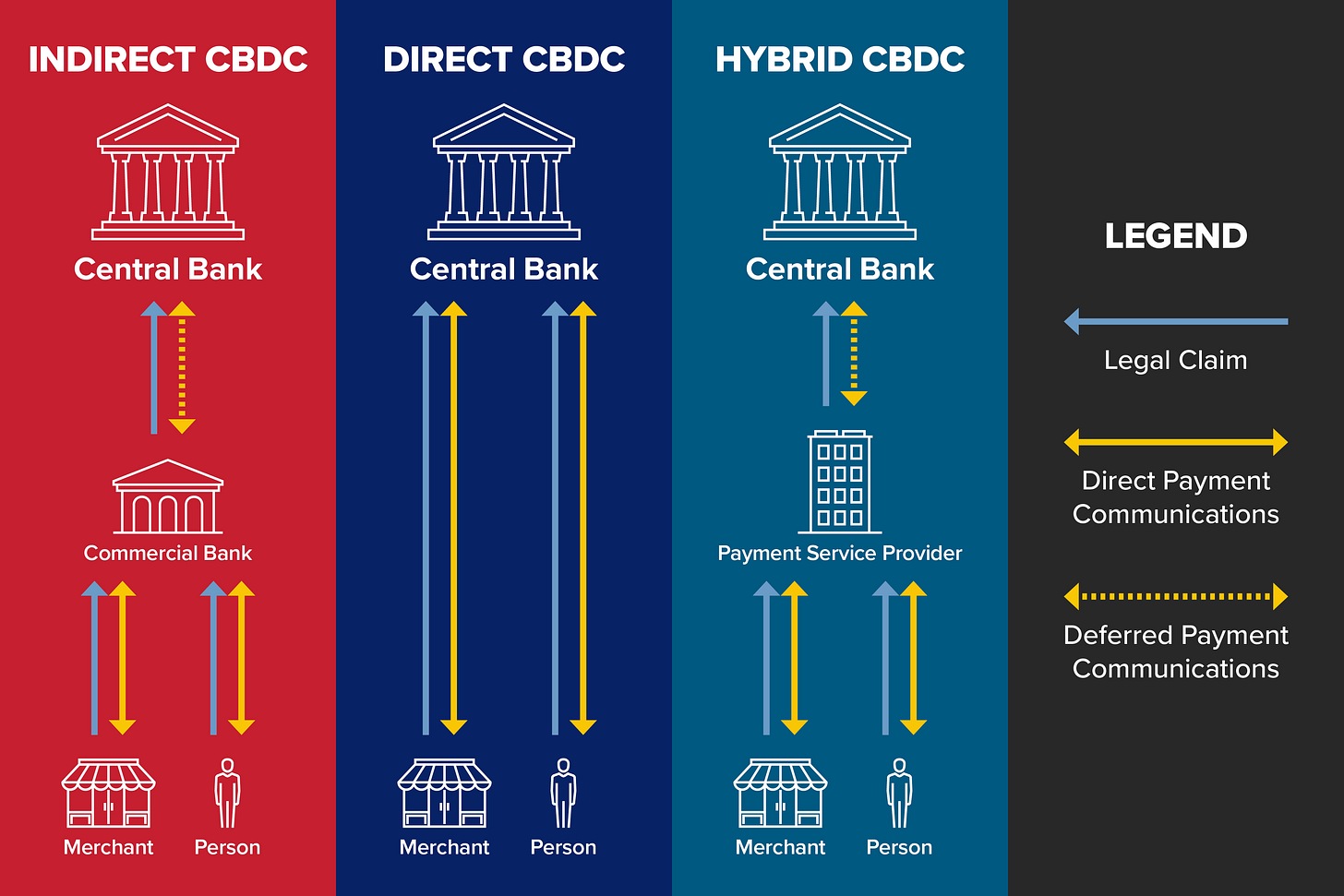

The Federal Reserve has recently expressed interest in developing a Central Bank Digital Currency (CBDC) as a way to address the issues created by fractional reserve banking.

They argue that a CBDC would allow for greater control and stability over the financial system, as well as providing a more efficient and convenient means of payment.

However, many point out that this is just a ploy for power and another example of a manufactured and manipulated crisis.

CBDCs are digital versions of physical currencies that are created by and backed by the central bank. They would be more stable and secure than traditional currencies, as they would not be subject to the risks of bank runs and collapses. However, CBDCs come with their own set of risks and controversies.

In a cashless society, all transactions would be conducted through digital means, allowing for greater surveillance and control over an individual’s financial activities.

One of the potential dangers of the CBDC is the integration of a digital ID and social credit system, which would result in a major loss of privacy and individual freedom.

A digital ID system would require citizens to have a unique identifier tied to their digital wallet, which would allow for all transactions to be traced and monitored by the government.

This could lead to a situation where individuals are unable to conduct financial transactions without government approval, effectively giving the government control over their finances.

Furthermore, the integration of a social credit system could grant governments the power to control financial freedoms of its citizens based on their social credit score.

This would result in a model where individuals are unable to access financial services or conduct transactions based on their behavior, effectively punishing them for actions that the government deems unacceptable.

Overall, fractional reserve banking can be seen as a form of legalized theft and a violation of individual property rights.

The continued bailout of these institutions only exacerbates the problem, which leads to greater economic instability.

Banks are using our money to build the infrastructure for a cashless society.

As more financial institutions begin to collapse, Central Bank Digital Currencies will be suggested to fix the problem.

While the concept of a digital currency may seem convenient, it is important to recognize the dangers it may bring.

The integration of a digital ID and social credit system must be thoroughly opposed to avoid a loss of individual freedom and privacy.